This month’s column comes from Melissa Garrett, Programme Manager at Young Enterprise. Melissa delivered this month’s Wellbeing Café talk: ‘‘How financial education fuels financial wellbeing.’

It was good to see so many of you at the Wellbeing Café in September. I know many IFW members share my passion for good financial education. For me personally, this was driven by a lack of such when I was young, resulting in a few poor choices in my early adult life.

I work at the youth education charity Young Enterprise; our charity mission is to empower young people to discover, develop and celebrate their skills and potential. The charity offers various programmes, services, support, resources and training to schools.

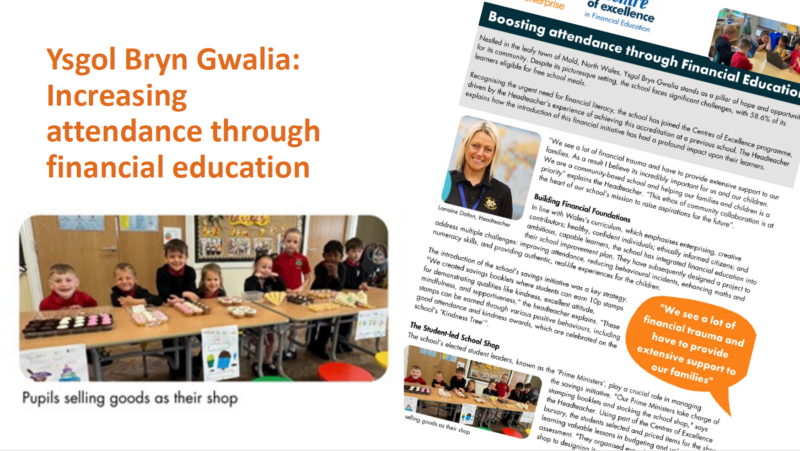

I manage a financial education programme called the Centres of Excellence. We have a pool of financial education experts (people like yourselves) that go into schools to provide support, guidance, resources and training to allow schools to embed financial education into their curriculum in a really meaningful and sustainable way and then recognise schools that are championing financial education. The key word there is ‘embed.’

How can I weave financial education in?

One of the big objections I commonly see in schools isn’t ‘Why should I teach this?’ Quite the contrary – the majority of schools I speak to see the value in financial education but the big challenge is where to fit it into an already packed curriculum. And that’s where I and our programme team can help schools. We promote and encourage ways that financial education is delivered not necessarily as an add on, but incorporated in the work that they’re already doing. For example, reworking a World War II module to scrutinise rationing or having a discussion about the world economy after reading a book on the Great Depression are effective ways to enhance learning and to incorporate financial education.

‘No Spendsday’ = behavioural change

On the subject of books, a Harrogate school married up World Book Day with financial education earlier this year by selecting a number of money-themed texts for their learners to read. A subsequent follow up activity was their ‘No Spendsday’ competition where pupils had to research and design a day out with their family that cost nothing. It’s fascinating just how creative and resourceful young people can be when set this challenge.

This is one of many great examples of ‘applied learning,’ where young people are given real-life scenarios or a simulated version to which to apply their learning.

This approach not only benefits young people, but schools too. A Wales school I work with have seen their overall pupil attendance increase by 4% in a term since the introduction of their school shop and rewards system. It’s such a simple and effective way of enhancing learning – in this case, the school have seen a huge behavioural shift towards saving rather than impulse buying too.

If you’re intrigued reading this and wondering how you might be able to support a school in enhancing their financial education offer or help bring it to life, please consider volunteering with us.

We involve thousands of volunteers across England and Wales each year, supporting a diverse range of experiences to young people in schools.

Details can be found here: Volunteer with us – Young Enterprise & Young Money (young-enterprise.org.uk)