IFW Annual Conference & Awards 2025

The IFW Annual Conference is on 20th May 2025, with an optional awards dinner and networking event on the evening of 19th May.

This year’s theme:

Identify>Understand>Implement

The festival of what we want, now and in the long-term.

The important details:

- When 19th & 20th May 2025 (Expert-led talks and discussions on 20th May with an awards dinner and networking on the evening of 19th May)

- Where Belton Woods Hotel, Spa & Golf Resort, Belton NG32 2LN

- What Two days of networking opportunities, talks from experts and discussions with likeminded professionals

IFW members can buy Early Bird member ticket here.

Non-members can purchase Early Bird non-member tickets here.

Early Bird tickets are on sale to IFW members and non-members until the end of March 2025. IFW members get a preferential rate. To take advantage of this, join the IFW.

Alongside monthly online events, the IFW Annual Conference offers the opportunity to catch up with each other face to face or meet for the first time in person. Check back for full details.

You’re also invited to join us at the same venue the night before for the IFW Awards dinner and social gathering. This relaxed gathering offers a great chance to network and make new connections while enjoying a sit-down meal.

Accommodation can be booked directly with the hotel – please quote IFW Conference when booking as we have already reserved some bedrooms in case these are required. Please note these are on a first come first served basis and the hotel is already quite full on this date. If accommodation is unavailable at the venue, please enquire about other hotels nearby. There are plenty to choose from.

The packed agenda covers a range of inspirational subjects with an increased number of opportunities for discussions, socialising and networking. We’re repeating the structure of last year’s conference so we’ll have several keynote speakers plus additional speakers facilitating and leading breakout discussions, so you can choose what you’d like to watch and listen to.

Speakers & Facilitators

The IFW Annual Conference brings together a broad cross section of industry professionals, experts and many of the Financial Wellbeing’s leading practitioners.

Please note that the programme is continuously being updated, so keep checking for the latest updates while we put the finishing touches to this year’s agenda

-

Dr Sonya Lutter, Ph.D., CFP®, LMFT – keynote– Practical ways behavioural science can help clients overcome money hang ups. Find out more.

-

Dr Thomas Mathar, Aegon UK – keynote – ‘What school didn’t teach you about money.’ Find out more.

- Jon Dunckley, founding director of the ‘About…’ Consulting Group – keynote – ‘Financial flourishing: Applied positive psychology and financial wellbeing.’ Find out more.

- Sarah Wallace, Just Finance Foundation – keynote – ‘Help clients explain money to the next generation.’

-

Alexandra Miles of Legal and General Investment Management, Founder chair of the Institute and Faculty of Actuaries Pension Gap Working Party and Co-chair of the Data and Research Group of an industry-wide Pensions Equity Group – breakout discussion – ‘Retirement Reimagined.’ Find out more.

- Sebastian Elwell, director of Switchfoot Wealth Limited – breakout discussion – ‘Wellbeing in a warming world – how financial planning may hold the key to everything.’ Find out more.

-

Becca Timmins, a consultant, coach and facilitator at When We Think –breakout discussion – ‘The magic of silence: The rare power of not interrupting.’ Find out more.

- Alan Whittle, founder of Unburdened Solutions, lecturer – breakout discussion – “Reading your clients to enable smarter financial decision-making.” Find out more.

The IFW one-day conference is a way of sharing and celebrating your Financial Wellbeing journey.

Enjoy a high quality and stimulating conference programme with leading experts and practitioners, making this the essential forum for the UK Financial Wellbeing sector to engage, debate and network.

Our ambition for this event is to create an opportunity for likeminded professionals with a passion for financial wellbeing to meet and share ideas, and also network in person.

This year we are supporting the following charities:

RedSTART is a children’s financial education charity, working only with primary schools that serve communities in areas of greater disadvantage. They see the same children repeatedly from Reception to Year 6 and combine in school lessons and workshops with a bank app and shop. They also use volunteers to connect the children to the world of work in order and raise aspirations.

This focus has allowed RedSTART to commission a unique longitudinal, randomised control study designed and run by The Policy Institute, King’s College, London which will measure the impact that this intervention has on the children as they grow up. The aim is for the charity to cease to exist beyond 2030 as the work they are doing will have resulted in policy change to support the delivery of similar interventions in every one of the 20,000 primary schools across the UK.

The Just Finance Foundation is a national charity committed to building a financially resilient nation where every individual has equal opportunity to thrive. They work directly with schools, families and communities to give every child an equal baseline understanding of money, regardless of their personal circumstances. This provides the essential foundation children need to become adults with the knowledge, skills and values to manage money wisely.

Who is this conference for?

This is a conference open to all. We want the debate about money, fulfilment and joy to involve everyone.

Whether you are a financial adviser, coach, planner, paraplanner, practice manager, fintech startup, product provider, marketing expert, charity or just an interested party, the IFW will help you achieve a fulfilling relationship with money.

It is also CPD accredited so you can use this event to go towards your annual CPD requirements, We will add a list of learning outcomes from our keynote speakers to help you learn more about the professional development you will receive from attending this event.

Support our event and the global Financial Wellbeing journey.

As a non-profit organisation, we have no shareholders and we are funded entirely through membership and event revenues. All proceeds from this event will be invested into supporting the future endeavours of the Institute for Financial Wellbeing as we work towards our mission to educate, empower and support people of all ages in every community to feel safe and confident around money by creating a space for conversation, collaboration and positive change.

Non-member tickets are also available to purchase – scroll down to the bottom or click here to purchase.

Who is speaking?

Dr Sonya Lutter, creator, researcher and author

Keynote: Practical ways behavioural science can help clients overcome money hang ups.

Dr Lutter leads curriculum and continuing education opportunities in financial psychology, financial therapy, and financial behaviour. She earned her PhD in Financial Planning from Texas Tech in 2010 and holds degrees from Kansas State University in marriage and family therapy and financial planning. Dr Lutter’s clinical work bridges the gap between mental health and financial planning. Her developmental work in financial therapy is summarised in Financial Therapy: Theory, Research, and Practice with co-editors Drs. Brad Klontz and Kristy Archuleta, based partly on her role as co-founder of the Financial Therapy Association.

Dr Lutter is also the creator and author of A Couples Guide to Love & Money: 15 Exercises to Strengthen Your Relationship. Her work at the financial counselling centres at Texas Tech University and Kansas State University have guided her effectiveness of financial counselling research agenda, which culminates with a co-edited book with Dr. Dorothy Durband titled, Student Financial Literacy: Campus-Based Program Development.

Dr Thomas Mathar, Aegon UK

Keynote: What school didn’t teach you about money.

Dr Thomas Mathar heads up Aegon UK’s Centre for Behavioural Research, supporting internal and external stakeholders with behavioural research and the application of nudge-theory to help people live their best lives, now and in the future.

Thomas has been with Aegon since 2016, having previously worked in research agencies and government, health, consumer industries and in finance.

Jon Dunckley, ‘About…’ Consulting Group

Keynote: Financial flourishing: Applied positive psychology and financial wellbeing.

Jon Dunckley is founding director of the ‘About…’ Consulting Group, a multi-disciplinary training and consulting organisation with specialisms in financial services and positive psychology. He is a keynote speaker, author, subject matter expert, and sought-after trainer. Before setting up About Consulting Group, he worked as a financial adviser and Head of Technical services for life insurers both onshore in the UK and offshore in Dublin.

A self-confessed geek, Jon is a fellow of seven different organisations and describes himself as one-part financial planner, one-part psychologist. He is currently researching whether personal resilience is impacted by a belief in manifesting.

Alexandra Miles, Legal and General Investment Management

Breakout discussion: Retirement Reimagined.

Kim Bendall will be moderating the Alexandra Miles discussion: ‘Retirement Reimagined?’ She is the founder of Go Paraplanning, and is a Fellow of the Personal Finance Society, Certified Financial PlannerTM and a CISI Fellow and Accredited Paraplanner. She moved into outsourced paraplanning in 2012 and founded Go Paraplanning in 2020. Go Paraplanning has grown organically since then, and now employs a team of very highly skilled and experienced paraplanners providing technical and consultancy support to a select group of like-minded, high-quality financial planning firms throughout the UK.

Sarah Wallace, Just Finance Foundation

Keynote: Help clients explain money to the next generation.

Sarah Wallace is the Director of The Just Finance Foundation, with overall responsibility for all aspects of the charity’s operations. Before JFF, she spent 19 years working for social action charities, including at The Royal British Legion, leading a broad portfolio of national services including Benefits, Money and Debt Advice services. She has also run employability services, respite care services and projects for young carers and has served on the boards of a youth education charity and a local Healthwatch.

Sarah is a member of the Youth Financial Capability Group, bringing together charities who have a significant focus on developing the financial capability of young people within the UK.

Sebastian Elwell, Switchfoot Wealth Limited

Breakout discussion: Wellbeing in a warming world – how financial planning may hold the key to everything.

Sebastian Elwell is director of Switchfoot Wealth Limited, a Certified B Corporation financial planning firm.

Sebastian is an Advisory Board member of SOLLA, Chair of the STEP Surrey Branch, a member of the PFS Sustainable Advice Forum and was recently invited to join the FCA’s ‘Adviser Sustainability Group’ which is due to report back to the FCA by the end of 2024.

Sebastian is also the author of ‘Sustainable Financial Planning’ a principles-based methodology to reform the financial planning process to take account of climate breakdown. Switchfoot’s mission is to make sustainable financial planning the default.

Becca Timmins, When We Think

Breakout Discussion: The magic of silence: The rare power of not interrupting.

Becca Timmins is a consultant, coach and facilitator at When We Think.

Becca has had a long career in financial planning, first as a Paraplanner and latterly as Operations Director at Emery Little. She now works with business owners and leaders, Financial Planners and teams, supporting them to uncover and realise their own potential and that of their clients. Her work is grounded in the Thinking Environment™, focusing on creating respectful, trusting relationships, deepening listening skills and asking better questions to support great thinking and ultimately, great outcomes.

Becca’s experience of coaching and training leaders and their teams has culminated in the launch of Unlocking Excellence, a coaching skills course specifically for Financial Planners wishing to deepen relationships with their clients, offer greater value, and simply do things better.

Alan Whittle, Unburdened Solutions,

Breakout discussion: Reading your clients to enable smarter financial decision-making.

After working as a Paraplanner, Compliance and Money Laundering Reporting Officer, Alan Whittle set up the Unburdened Consultancy in 2019 with the intention of supporting smaller financial planning firms in the areas of compliance and professional development. Alan has combined this with his love of developing the next generation of financial professionals, bridging the gap between the academic and professional spheres as a Lecturer at Robert Gordon’s University on both Financial Planning and Sustainable Finance.

A great believer in lifelong learning, Alan holds an MSc in Financial Planning and Business Management, the focus of which was the Motivations for Responsible Investing. He has recently completed a successful defence of his thesis for a PhD in Financial Planning, the subject of which is the intersection of Behavioural Finance and Impact Investing, how reference dependence, frames and framing impact investment decision-making.

Tom Morris, Ovation

Panel discussion: How to avoid the bumps in the FW road.

Tom Morris is taking part in the panel discussion ‘How to avoid the bumps in the FW road.’ The discussion will cover how to incorporate financial wellbeing into processes.

Tom is a Director and Chartered Financial Planner at Ovation Finance, based in Bristol. He was a founding Director of the IFW when it launched as the Initiative for Financial Wellbeing in 2019.

Tom has been researching the topic of financial wellbeing for over six years and uses it to help individuals and business owners plan for the future.

Chris Budd, IFW founder

Chair of breakout discussion: What school didn’t teach you about money.

Chris Budd is chairing the breakout discussion with Dr Thomas Mathar: ‘What school didn’t teach you about money?’

Chris founded the Institute for Financial Wellbeing. He is the author of six books, including The Financial Wellbeing Book and The Four Cornerstones of Financial Wellbeing. He is also the architect of the Financial Wellbeing Pulse, a tool for measuring financial wellbeing. In 2018 he sold the majority of his financial planning company Ovation Finance Ltd, the company he founded in 2000, to an Employee Ownership Trust. Chris lives in Somerset with his family and too many guitars.

Hiren Panchal, IFW Vice Chair and founder of Wensons Financial and Wensons Legacy

Chair of panel discussion: How to avoid the bumps in the FW road.

Hiren Panchal will chair the panel discussion ‘How to avoid the bumps in the FW road.’ The discussion will cover how to incorporate financial wellbeing into processes.

Hiren is Vice Chair of the IFW as well as being a Certified Financial Coach and Founder of Wensons Financial and Wensons Legacy.

Hiren Panchal provides trusted advice and guidance to help clients live the lives they visualise.

Mark Polson, The Lang Cat

Keynote: Apply your own mask first before helping others: how well is the industry and profession faring?

Mark Polson is founder and principal of the lang cat, a specialist platforms, pensions and investment consultancy. From its Edinburgh base, the lang cat works with platforms, life companies, asset managers and large advisory firms helping them interpret regulation, develop new propositions, turn marketing strategy into action and articulate their services in such a way that people without a financial services degree have a hope of understanding them. Bit by bit it aims to leave the industry just a little better than it found it.

The lang cat is also a strategic communications agency, offering PR and communication services to clients across retail investment, protection and fintech. The comms guys have access to the techy guys, and the techy guys are helped by the comms guys to communicate with impact. It’s a good mix.

Mark is a prolific writer, contributor to the trade press and international public speaker, even when people ask him not to be. He doesn’t play guitar as much as he’d like and spends more time than is reasonable going to gigs aimed at people considerably younger and more tattooed than him.

Martin Ruskin, Paradigm Norton

MC

Martin Ruskin has spent over 30 years providing independent, specialist financial planning advice and is one of the UK’s most qualified advisors, being both a Certified Financial Planner and Chartered Fellow (Financial Planning). He was Director of David Jones Financial Planning, which merged with Paradigm Norton (‘PN’) in September 2010 and seen PN become one of the best known, independently owned financial planning businesses in the UK. He was a board member of the Institute of Financial Planning and Chartered Institute of Securities and Investments (‘CISI’), where he also chaired the Financial Planning Forum. As well as his role as Client Director, Martin also sits on the PN Employee Owned Trust board.

PN is a multi-award-winning , employee-owned firm with a strong commitment to exceptional client care and sustainable business practices. As a Certified B Corporation, PN balance purpose with profit, ensuring that our values align with those of our clients.

Martin loves to travel and live the advice that he gives to his clients – that life is not a rehearsal and should be embraced fully and wholeheartedly. And whilst money matters, life matters more.

Philippa Hann, Paradigm Norton

Panelist: How to avoid the bumps in the FW road.

Philippa Hann is the CEO of Paradigm Norton and is committed to empowering the team to grow, innovate, and thrive. As the recently appointed CEO, she’s most looking forward to leading a firm that prioritises positively impacting its people, its clients and the world around us.

Philippa has spent the best part of 20 years working as a lawyer in the financial sector. She is passionate about high standards of care and service. To this end Philippa has regularly spoken at industry events and written for financial journals, including writing her own book alongside neuro-psychologist Dr Moira Somers on why financial advice can sometimes go wrong, delving into the psychology of the individuals involved. She is also a qualified (but non-practicing) financial adviser.

Philippa holds a number of non-executive roles and is passionate about leadership development, often coaching professionals to maximise their potential

Lucy Woolrich, Equilibrium

Panelist: How to avoid the bumps in the FW road.

Lucy Woolrich is the Head of Organisational Development at Equilibrium, having joined as a paraplanner in 2007. Lucy’s passion for continuous learning and nurturing talent led her into the learning and development space. She is dedicated to supporting and developing the growth and effectiveness of Equilibrium through its people. She is a Master Practitioner of NLP, a qualified Life and Business Coach, and a Fellow of the Personal Finance Society.

Sarah Lyons, Parmenion

Panelist: How to avoid the bumps in the FW road.

Sarah Lyons’ unwavering focus at Parmenion is to make sure we think customer first, and that what we do for our adviser partners and their clients makes a real difference. With more than 30 years financial services experience, her career has spanned everything from developing propositions to brand and communications and working in distribution and delivery. In her current role, Sarah is responsible for the end-to-end development and delivery of Parmenion’s award winning products and services. She believes success lies in being both perpetually curious and delivery focused which drives a shared determination in our business to never stop improving and making tomorrow better, for everyone.

Jonathan Newell, BareRock

Breakout: PI but not as you know it!

Jonathan Newell has nearly 30 years of industry experience with his creative side and curious imagination, Jonathan is the driving force behind our company’s innovative spirit and underwriting excellence.

As CEO and lead underwriter, he draws on his deep industry knowledge to steer our underwriting approach, while fostering a culture of collaboration and creativity that empowers the team to deliver on our mission: providing not just great customer outcomes, but also an unparalleled user experience that sets us apart in the industry.

His extensive background in insurance broking, underwriting and risk assessment, combined with his forward-thinking approach, ensures BareRock maintains its position at the forefront of PI underwriting innovation, using data-driven insights to understand and serve our clients better.

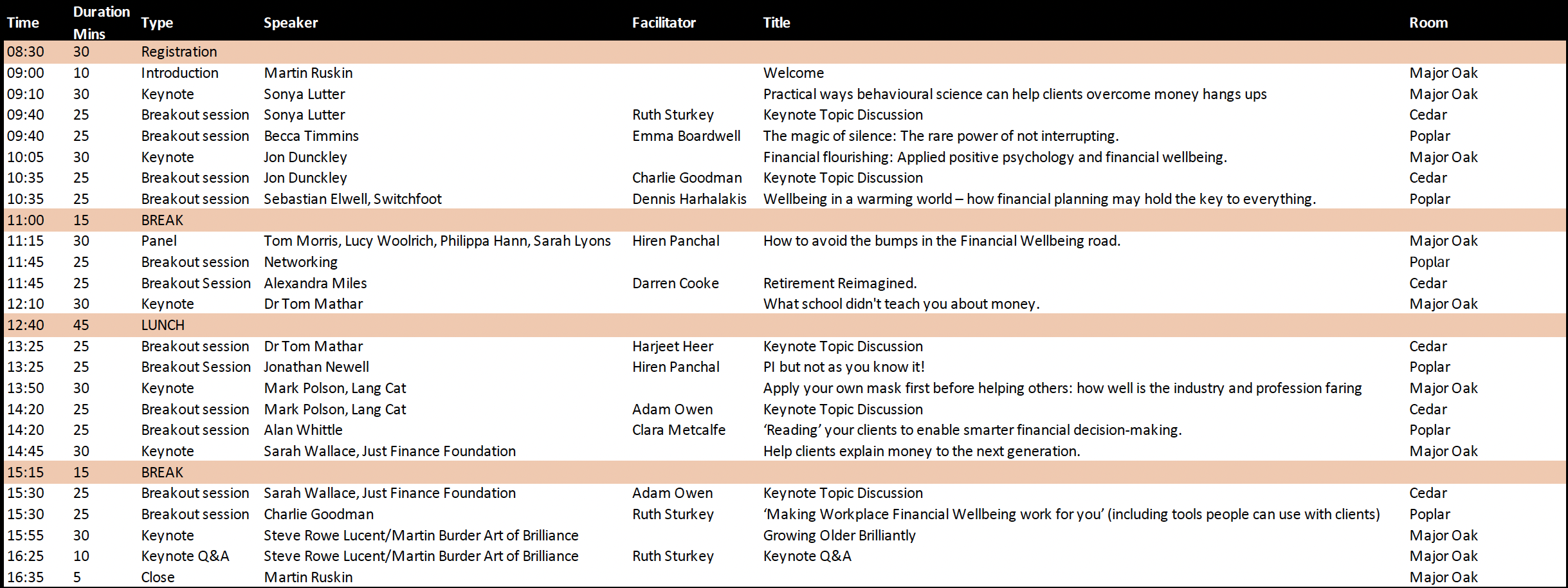

Agenda

Our Agenda is being updated regularly; please check back to see additional speakers / sessions. Thank you.

| Time | 20th May | ||||

| Morning | |||||

| Time | Type | Speaker | Breakout 1 | Breakout 2 | Title |

| 08:30-09:00 | Registration | ||||

| 09:00-09.10 | The IFW

Welcome. | Martin Ruskin | Welcome | ||

| 09:10-09:40 | Keynote | Sonya Lutter | Practical ways behavioural science can help clients overcome money hangs ups | ||

| 09:40-10.05 | Breakout session | Sonya Lutter | Becca Timmins | The magic of silence: The rare power of not interrupting. | |

| 10:05-10:35 | Keynote | Jon Dunckley | Financial flourishing: Applied positive psychology and financial wellbeing. | ||

| 10:35-11:00 | Breakout session | Jon Dunckley | Sebastian Elwell, Switchfoot | Wellbeing in a warming world – how financial planning may hold the key to everything. | |

| 11:00-11:15 | BREAK | ||||

| 11:15-11:45 | Panel | Tom Morris, Lucy Woolrich, Philippa Hann, Sarah Lyons | How to avoid the bumps in the Financial Wellbeing road. | ||

| 11:45-12:10 | Breakout session | Networking | Alexandra Miles | Retirement Reimagined. | |

| 12:10-12:40 | Keynote | Dr Tom Mathar | What school didn't teach you about money. | ||

| 12:40-13:25 | LUNCH/NETWORKING |

| Afternoon |

| 13:25-13:50 | Breakout session | Dr Tom Mathar | Jonathan Newell | PI but not as you know it! | |

| 13:50-14:20 | Keynote | Mark Polson, Lang Cat | Apply your own mask first before helping others: how well is the industry and profession faring | ||

| 14:20-14:45 | Breakout session | Mark Polson | Alan Whittle | ‘Reading’ your clients to enable smarter financial decision-making. | |

| 14:45-15:15 | Keynote | Sarah Wallace, Just Finance Foundation | Help clients explain money to the next generation. | ||

| 15:15-15:30 | BREAK | ||||

| 15:30-15:44 | Breakout session | Sarah Wallace | Charlie Goodman | ‘Making Workplace Financial Wellbeing work for you’ (including tools people can use with clients) | |

| 15:55-:16:25 | Keynote | Steve Rowe Lucent/Martin Burder Art of Brilliance | |||

| 16:25-16:35 | Keynote | Q&A Steve Rowe Lucent/Martin Burder Art of Brilliance | |||

| 16:35-16:40 | Close | Martin Ruskin |